If you are currently providing contracting services via a labour-hire business (such as a temp agency), they are required to deduct 20% before paying you. This is Withholding Tax and they pay this to Inland Revenue at the same time they pay PAYE for their employees.

The payments made to you as a contractor are called Schedular Payments. You're not an employee, but you get the benefit of having income tax deducted before it hits your bank account. It's a good alternative to being in the IRD's provisional tax regime, which requires larger payments from you every four months.

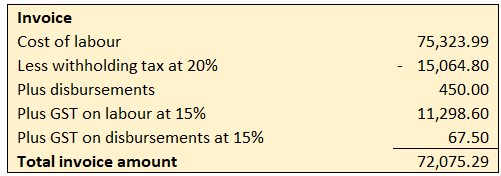

With regards to deducting withholding tax, this needs to be deducted from every invoice. There is no GST on withholding tax. Your invoice will look something like this:

If you're receiving Schedule Payments, you're still considered to be a sole trader and will need to prepare a tax return at the end of the year.

You can apply to IRD for an exemption from Withholding Tax if you like. However, having the tax deducted throughout the year can be a more proactive way of managing the tax, rather than having a larger tax bills every four months and perhaps also a top-up tax at year end. This does comes down to personal preference.

Inland Revenue provides more information on Schedular Payments here.